Top 10 Post-Pandemic Tech Trends

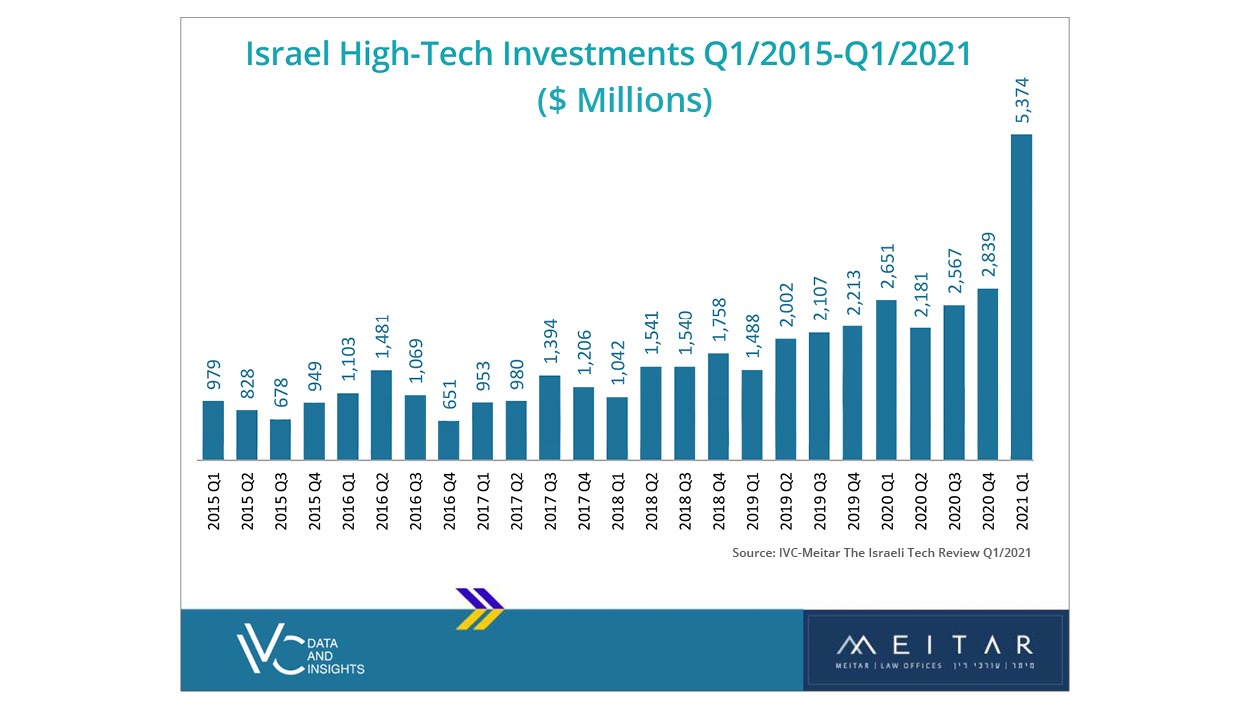

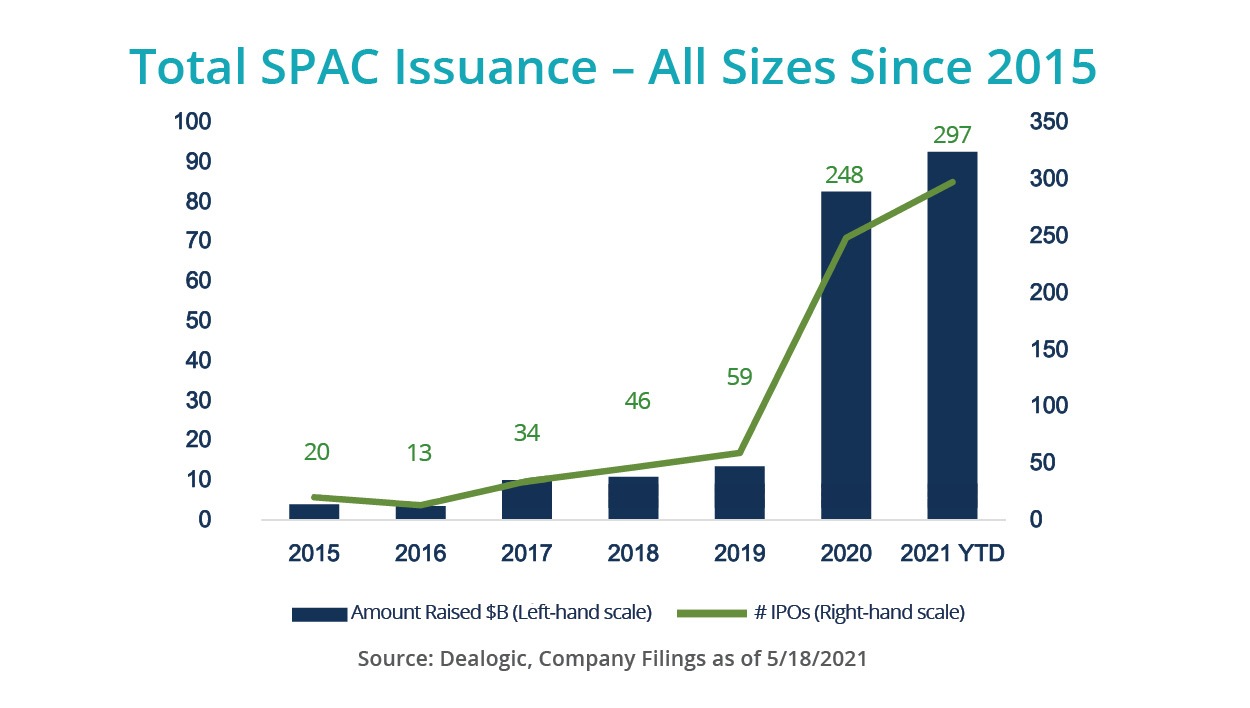

by OurCrowd OurCrowd presented its top ten post-pandemic tech trends on July 13, 2021, broadcasting them live to an audience around the world. With so many changes and challenges during the last year of the pandemic, from shortages of consumer goods to moving life online, the tech industry has been more important than ever in providing creative solutions. It has also been a record-breaking year for venture capital investing, and overall growth in the tech industry. The online event was based on a popular session of the OurCrowd Global Investor Summit held annually in Jerusalem and which was canceled this year due to the pandemic. “It’s extremely important this year given the unprecedented growth of the tech investment scene driven by the unbelievable digital transformation that has affected all of our lives,” said Jon Medved, the founder and CEO of OurCrowd, as he opened the event. “There is no better time to analyze what the tech trends are for the smart investor, and where the technology market is moving.” Many of the ideas and solutions that emerged during the...

Read More